Table of Content

Confident that your assets are being manage in your best interest.Everything is being done on time. You’d always get a professional answer to any question big or small.For me the question about who are the best property management has an obvious answer! Reliable, transparent and always available to answer my questions.

To this figure, you can add the cost of any additions and improvements you made with a useful life of over one year. The property was acquired through a 1031 exchange within five years. Dana Anspach is a Certified Financial Planner and an expert on investing and retirement planning.

Everything to Know About Paying Capital Gains Tax on a Second Home Sale

If you exceed profit levels of $250,000 or $500,000, the excess is a capital gain, which you must pay tax on. You may sell a building and accept payment in installments, which can spread the tax liability over a number of years. If you agree on a down payment followed by monthly or annual payments, you’d pay taxes based on the percentage of your profit on each payment received during the year, but not the total gain. In the end, however, the total taxes you pay would likely be the same as if you had paid them all at once—barring future changes in the tax rate. You’ve delayed taxes rather than avoided them, Levine explained. You may also have paid those taxes at an average rate lower than the rate you would have paid if you had paid tax on the entire gain in the year of sale.

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.

How to avoid capital gains tax on a home sale

The money you make on the sale of your home might be taxable. An interesting twist on the taxability of rentals and leases can arise with equipment that is provided with an operator. Some states do not impose tax on leases or rentals of equipment if the equipment is provided with an operator. In these cases, the state considers the charge to be for a service and not for the lease or rental of property. You need to have owned and lived in the property for at least two years. ❌ Don’t report the home sale if all of your gain is tax exempt.

This means, of course, that you’ll need to calculate the profit you’ve made from selling your home in order to determine if you’ll owe taxes on the sale of your home. This calculation isn’t as simple as subtracting the price you paid from your sale price though. You used to have a one-time option of excluding up to $125,000 in capital gains on the sale of your home, as long as it was your primary residence and you’d reached the age of 55. There are countless details involved in selling a home, including the tax implications.

How to Avoid Paying Capital Gains Tax When Buying Another Rental Property

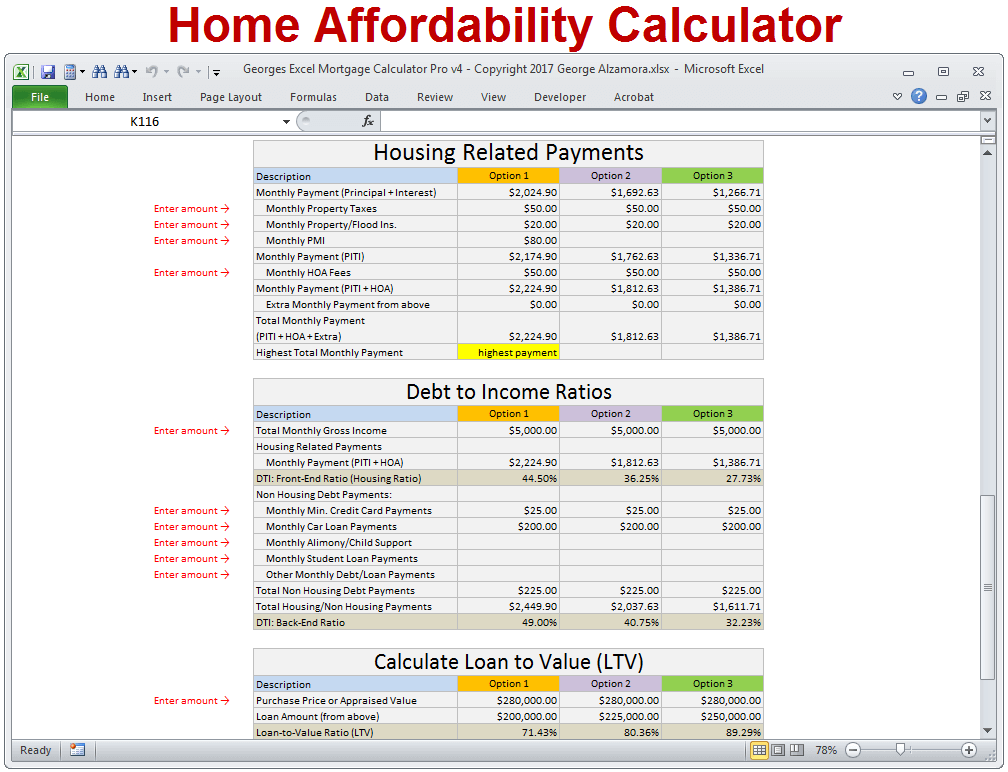

The higher your adjusted cost basis, the lower your capital gain when you sell the home. The most common ways to reduce capital gains tax exposure include 1031 exchanges, converting a rental property to a primary residence, tax-loss harvesting, and monetized asset sales. As you can see, trying to avoid paying capital gains taxes on a second home sale can happen with proper financial planning. If you want to completely avoid paying capital gains tax when you sell your second home, you can do this if you’ve lived in it for 2 of the past 5 years as your primary home. This doesn’t have to be two consecutive years, so you could avoid paying the tax altogether if you can spend some extra time living in the property. When you sell a second home that you have owned for more than a year, you will be subject to long-term capital gains tax rates.

Let’s say Mom and Dad bought the family home years ago for $100,000, and it’s worth $1 million when it’s left to you. When you sell, your purchase price (or “basis”) is not the $100,000 your folks paid, but instead the $1 million it’s worth on the last parent’s date of death. Complicating matters is the Tax Cuts and Jobs Act, which took effect in 2018 and changed the rules somewhat.

The intermediary flips the property to the final buyer for cash. Meanwhile, the third-party lender steps in and lends the original seller an amount equal to 95% of the final buyer’s purchase price. The escrow agent pays the interest payments on this 30-year note, canceling out the interest income on the installment loan, which is flowing through the same escrow account. Any previous capital gains exclusion claims must have occurred more than two years prior to the sale.

Under the Tax Cuts and Jobs Act of 2017, up to $750,000 of mortgage interest on a principal residence or vacation home can be deducted. However, if a property is solely used as an investment property, it does not qualify for the capital gains exclusion. Short-term capital gains are taxed as ordinary income, with rates as high as 37% for high-income earners. Long-term capital gains tax rates are 0%, 15%, 20%, or 28% for small business stock and collectibles, with rates applied according to income and tax-filing status. While it’s possible you’ll have to pay taxes on the sale of your home, chances are you won’t have to. If you meet a few simple requirements, up to $250,000 of profit on the sale of your home is tax-free.

Get free, objective, performance-based recommendations for top real estate agents in your area. If you have a gain from the sale of your main home, you may be able to exclude up to $250,000 of the gain from your income ($500,000 on a joint return in most cases). The content on this site is not intended to provide legal, financial or real estate advice. It is for information purposes only, and any links provided are for the user's convenience.

A monetized installment sale is a complex arrangement that’s often touted as a viable strategy to reduce capital gains taxes. In May 2021, the IRS released a document calling the transactions “problematic” and highlighting six ways certain MIS deals may not provide the tax benefits being sought. The ordinary income that you should report in the year of the sale is the amount by which the FMV of the stock at the time of purchase exceeds the purchase price.

If the sales price is $250,000 ($500,000 for married people) or less and the gain is fully excludable from gross income. The homeowner must also affirm that they meet the principal residence requirement. The real estate professional must receive certification that these attestations are true. Homeowners can avoid paying taxes on the sale of a home by reinvesting the proceeds from the sale into a similar property through a 1031 exchange. The 1031 exchange allows for the tax on the gain from the sale of a property to be deferred, rather than eliminated. There are ways to reduce what you owe or avoid taxes on the sale of your property.

When you are selling a second home and are trying to understand the tax consequences, hiring a tax advisor could be worth it. With the sale of a second residence, the internal revenue code allows you to deduct property taxes. For this reason, it’s often better to get professional advice to avoid a sale of second home tax. Rental properties are considered to have a useful life of 27.5 years, and this means it depreciates by 3.636% each year of the cost basis. The cost basis is the value of the property plus fees and commissions spent when purchasing, but minus the land value.

Payments for the lease of tangible personal property are exempt from tax if the sale of the tangible personal property would be exempt. This structure theoretically allows the seller to postpone capital gains recognition on the home sale for 30 years. Again, the IRS doesn’t recommend it, so if you’re considering this strategy, explore your options with a CPA.

No comments:

Post a Comment